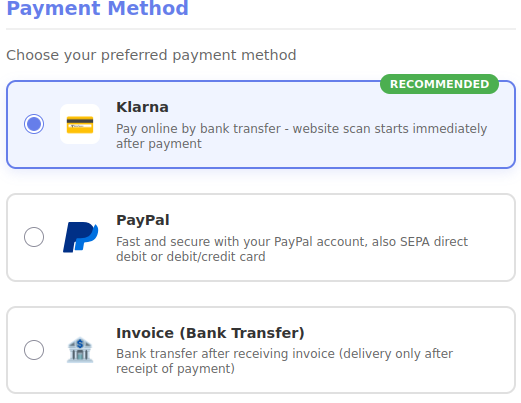

Who sells digital products or services is faced with the question: Which payment methods should I offer my customers? The answer is more complex than it seems at first. Digital products should be digitally payable – but between user-friendliness, fee structure, data protection and technical integration there are significant differences.

The established providers: Klarna and PayPal

Klarna has established itself as the European provider and offers retailers a significant advantage: the money collected is automatically transferred to the retailer's account minus a fee. This automation saves manual work and provides planning security. As a Swedish company that has taken over the former DIRECT transfer, Klarna enjoys trust among many users – even if not every customer wants to use this service.

PayPal, on the other hand, remains a double-edged sword for many merchants. On the one hand, many customers expect this payment option, but on the other hand, the provider makes the transfer of the collected money from the PayPal wallet to the merchant's own bank account unnecessarily complicated. PayPal's market dominance often makes it indispensable, even if a merchant would rather do without it. Moreover, PayPal is an American service with questionable figures like Peter Thiel in the background. Profit maximization and market dominance are paramount here, without regard for losses (for others).

Selling digital products for 15 euros – economically and conveniently.

That was the goal, which was achieved.

WERO: The European Alternative Facing Initial Challenges

The new European payment solution WERO impressively demonstrates how simple digital payments can be. In practice, the initial setup, including the transfer, often takes only a few minutes – a clear advantage for end users.

However, this is precisely the problem: there is no direct interface for merchants. Instead, intermediaries like PAYONE must be involved, which comes with consultation fees and setup costs.

This added complexity currently makes WERO unattractive for smaller merchants. As soon as direct integration becomes possible, that could change – the potential is definitely there.

In any case, sending and receiving money via WERO is child's play. To do this, WERO only needs to be activated in your own banking app. Afterwards, money can be sent to the recipient via their mobile phone number.

The underestimated classic: Purchase on account

Bank transfers are often underestimated, but they offer compelling advantages. For privacy-conscious customers, it is the preferred option as it does not involve any additional service providers. Merchants save on transaction fees. With real-time transfers, the payment is also completed within seconds or minutes – the previous criticism regarding long waiting times is therefore no longer valid.

Especially interesting is the practical implementation: Instead of immediately issuing an invoice, the customer first receives a payment request. The actual invoice is only created on request – and that after payment receipt with the note "Amount already received". This approach avoids cancellation costs if customers do not pay. In combination with a HBCI interface that automatically queries account transactions, even the purchase invoice can be fully automated.

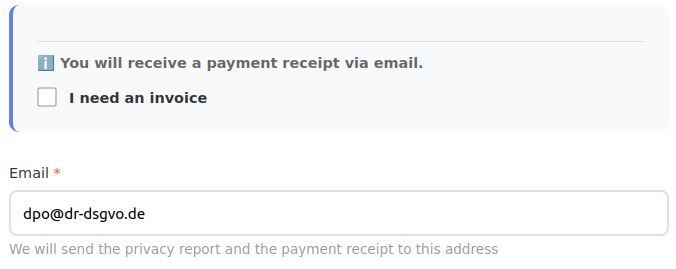

Only if the customer requires an invoice do they need to enter their address details, and only then. So no one can complain about having to enter too much data.

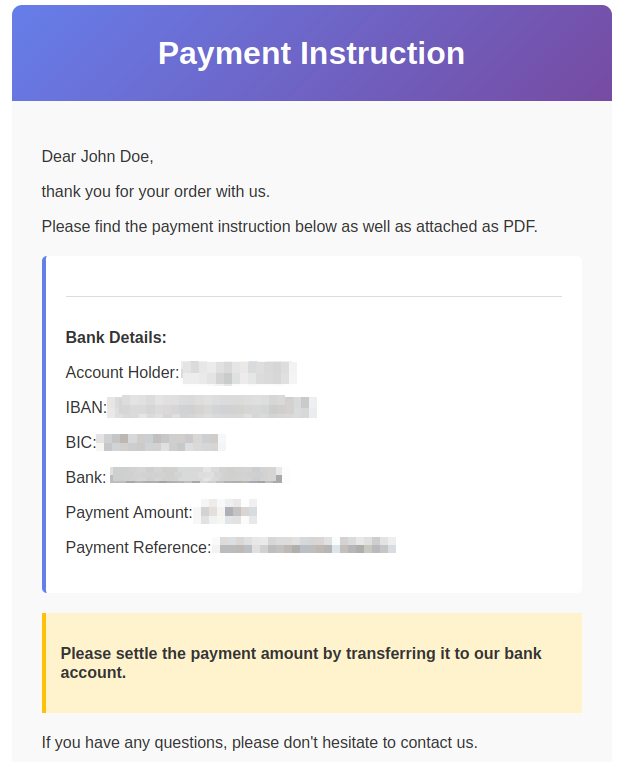

For payment by bank transfer, the customer receives an email with a payment instruction.

After payment is received, the customer receives another email with the already paid invoice.

The customer receives a payment confirmation with other payment methods (Klarna, PayPal), or upon request also an invoice (with the note "amount received thank you via payment service provider XY").

Data privacy

Unlike many other online shops and sales platforms, no third-party plugins are integrated, except when necessary.

Another difference is that many online shops always load the PayPal plugin, regardless of whether the visitor wants to make a purchase or whether they choose PayPal or another payment method.

This ensures that data is not processed unnecessarily. As a small detail, it's worth mentioning that customers receive a convenience feature for recurring purchases without consent: the previously entered data is pre-filled. This only applies to customers, not random website visitors! Even though PayPal wasn't or shouldn't be a role model: they do the same thing.

AI-driven Development: Efficient, but Controlled

The technical implementation of our order platform was carried out with the support of AI programming. The result is a powerful online ordering page, fully available in both German and English. The internationalization of the highly dynamic privacy policy, which is also generated in both languages, proved to be particularly challenging.

What was important for us in this case was a conscious abstinence from so-called Agentic Coding – that is, fully autonomous AI systems that write code independently and make decisions on their own. The reasons for this are of a technical nature: Agentic Coding is opaque because the decision-making paths of the AI cannot be traced back. At the same time, it is particularly error-prone because there is no direct human control over each programming step. For productive systems that work with customer data and payment processes, this approach is simply too risky.

Instead, we leveraged AI as a powerful tool: to accelerate development, enhance code quality, and efficiently implement multilingual support. However, human oversight and responsibility remained paramount – a balance between efficiency and security that has proven effective.

The right mix is key

For our GDPR website check, we have opted for the following offer: (Note: I kept the square brackets as they were, assuming they are part of a reference or citation):

My name is Klaus Meffert. I have a doctorate in computer science and have been working professionally and practically with information technology for over 30 years. I also work as an expert in IT & data protection. I achieve my results by looking at technology and law. This seems absolutely essential to me when it comes to digital data protection. My company, IT Logic GmbH, also offers consulting and development of optimized and secure AI solutions.

My name is Klaus Meffert. I have a doctorate in computer science and have been working professionally and practically with information technology for over 30 years. I also work as an expert in IT & data protection. I achieve my results by looking at technology and law. This seems absolutely essential to me when it comes to digital data protection. My company, IT Logic GmbH, also offers consulting and development of optimized and secure AI solutions.